GSTR-9: All about GSTR 9, Annual return, Eligibility, Format & Rules

- Balance Sheet Maker

- Jul 20, 2019

- 4 min read

Updated: May 16, 2021

GSTR-9 is an annual return to be filled yearly by taxpayer register under GST. It consists of detailed information about Inward and outward supply made during a relevant financial year. In this, we provide consolidated details of monthly/quarterly returns.

Key features of this blog.

Types of GSTR-9

Details to be filled in GSTR-9

Eligibility for filing GSTR-9

Due date of filing GSTR-9

Penalty for late filing of GSTR-9

What are the types of GSTR-9

There are 4 types of GSTR-9 (annual return).

GSTR-9: Taxpayers who are filing GSTR 1 & GSTR-3B Should File GSTR-9.

GSTR-9A: Those taxpayers who are registered under the composition scheme should file GSTR-9A.

GSTR-9B: E-commerce operators, who have filed GSTR-8 during the financial year should file GSTR-9B.

GSTR-9C: Taxpayers whose Aggregate turnover in more than 2 crores during the relevant financial year Should have to file GSTR-9C.

What details to be filled in GSTR-9

GSTR-9: GSTR-9 is divided into 6 parts and 16 sections from 3 to 18. Details of each section are easily available in GSTR-1 and GSTR-3B you filed during the financial year.

First part is consist of 1 section that is called HOME in which we fill the GSTIN of our organisation and Financial year for which we are filing the return.

The second part is consist of 2 sections 4 & 5, in which we fill the details of outward and inward supplies. See below table for detailed info.

The third part is consist of section 6, In which we have to fill details of ITC claimed in the financial year. See below table for detailed info.

The fourth part is consist of three sections from 7 to 9, in this, we have to fill in details of ITC reversed, other ITC & Information of tax paid. See below table for more info.

The fifth part is consist of 5 sections from 10 to 14, in which section 10 to 13 are included in section 10. in simple word section, 10 to 13 work as subsections of section 10. for more clarity see below table.

Last but not least part 6 is consist of 4 sections from 15 to 18, In this, we have to fill the details of demand occurred and HSN summary. see below table for more details.

What details to be filed in GSTR-9A

2. GSTR-9A: Now we will learn about the details we have to fill in GSTR-9A. There are 5 parts and 11 sections ( from 6 to15) in GSTR-9A. Taxpayers who opted for Composition scheme File this return. Now let's see about all these parts in detail.

The first part is consist of home same as part 1 of GSTR-9A, we have to fill here GSTIN and financial year.

The second part consists of outward and inward supplies made during the financial year. see below table for detailed info.

Third Part consists of the only one table no. 9 in which we have to file the details of tax paid during the financial year. see below the detailed info about it.

Fourth Part consists of four tables ( from 10 to 14) in which the details of amendments of the previous year that are done in the current year from April to September. see below table to understand each table clearly.

Last part no. 5 is consist of 2 tables ( from 15 to 16) in this we fill the details about demand and refunds and credits reversed. See below table for more details.

What details to be filled in GSTR-9C

3. GSTR-9C- This return has to be filed by taxpayers whose annual turnover exceeds 2

crore would need to get his accounts audited as specified under sub- section (5) of section 35 of the GST Act. this is divided into 2 parts A & B.

Part A- Basically part A contains reconciliation statement in five points from pt I to pt V lets go deep in this.

PT I- Point 1 contains the basic information of a firm like GSTIN, Name of the firm etc.

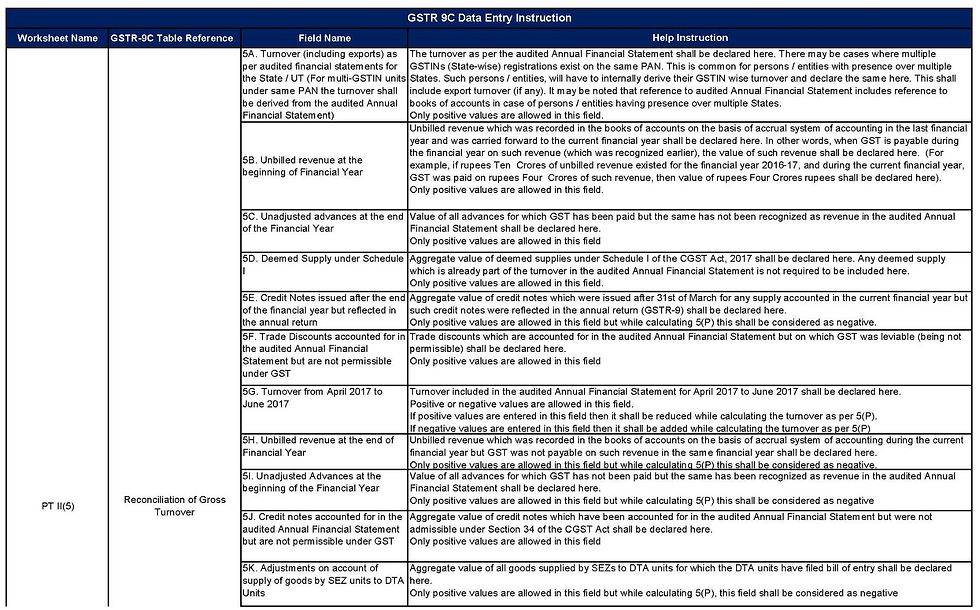

PT II- Point II contains 4 sheets from PT II(5) to PT II(8) in which you have to fill the details of Reconciliation of turnover declared in audited Annual Financial Statement with turnover declared in Annual Return (GSTR9). See below details for more understanding.

PT III - PT III contains 3 sheets from PT III(9) to PT III(11) in which you have to fill the reconciliation of tax paid. see below for more.

PT. IV- PT. IV contains 5 sheets form PT IV(12) to PT IV(16) in which you have to fill the reconciliation of input tax credit (ITC). see below for more.

PT. V- PT. V contains only one sheet in which you have to fill the auditor's recommendation on additional liability due to non-reconciliation.

2. Part B- Part B contains 2 sheets Part B(i) & Part B(ii) in which you have to fill

certifications detail of each certification is given below.

Part B(i)- This certification is used in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by the person who had conducted the audit.

Part B(ii)- This certification is used in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by a person other than the person who had conducted the audit of the accounts.

What is the eligibility for filing GSTR-9 (Annual Return)

All Taxpayers/Taxable persons registered under GST have to file GSTR-9 annual return.

However, the following are not required to file GSTR-9.

Casual taxable person

Input service distributors

Non-resident taxable persons

Persons paying TDS under section 51 of the CGST act.

What is the due date of filing GSTR-9

GSTR-9 is to be filed on or before the 31st of December of the subsequent financial year.

Sometimes Government extends date because of some reasons just like they change fo the financial year 2017-2018.

For fy 2017-2018, the due date for filing GSTR-9 has been extended again from 31st Aug 2019 to 30th Nov 2019.

For fy 2018-2019, the due date for filing GSTR-9 is 31st Dec 2019

What is the penalty for late filing of GSTR-9

The late fees for not filing the GSTR-9 within the due date is Rs 100 per day as per the act. That means late fees of Rs 100 under CGST & Rs 100 under SGST will be applicable in case of delay. Thus, the total liability is Rs 200 per day of default. This is subject to a maximum of 0.25% of the taxpayer’s turnover in the relevant state or union territory. However, there is no late fee on IGST yet.

Important note: Once you filled GSTR-9 you can't revise it so File it carefully

Comments